Wednesday, January 30, 2008

Fed slashes rates as US recession looms

Meredith Whitney fears $70bn carnage on monoliners

The high-profile banking analyst who triggered the resignation of Citigroup chairman Charles "Chuck" Prince is predicting investment banks will need to take further write-downs of $40bn (£20bn) to $70bn as a result of the current crisis in the bond insurance market.

The high-profile banking analyst who triggered the resignation of Citigroup chairman Charles "Chuck" Prince is predicting investment banks will need to take further write-downs of $40bn (£20bn) to $70bn as a result of the current crisis in the bond insurance market.READ THE REST

UK house-price slowdown deepens

The slide in the housing market gathered more pace last month, increasing speculation that the Bank of England's Monetary Policy Committee will cut interest rates at its meeting next week.

Mortgage approvals slumped to just 73,000, the lowest level since records began in 1999, accelerating the downward trend. Approvals dropped from 113,000 in June to 99,000 in September and 81,000 in November.

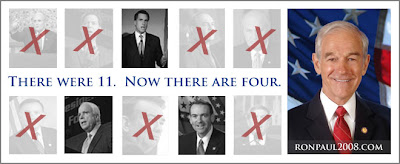

You say you want a revolution?

Every movement in history has faced some time of testing, some experience that either forges it into something strong and unified, or forces it to fade away into the history books as another failed experiment.

Every movement in history has faced some time of testing, some experience that either forges it into something strong and unified, or forces it to fade away into the history books as another failed experiment.We've been here before. In 1776, despite a courageous effort at holding onto the city, George Washington ceded New York and quickly retreated to New Jersey.

1. Become a precinct leader today: It's easy, but more importantly, it's vital to Ron Paul's success: https://voters.ronpaul2008.com/.

2. Donate: Just as the Continental Congress supplied General Washington's troops in the field, we too must raise as much money as we can to equip our grassroots supporters.

Help us win this revolution and usher in a new era of freedom, peace, and prosperity. Donate today: https://www.ronpaul2008.com/donate.

Bank Reserves Go Negative

I have been watching a chart of Borrowed Bank Reserves for several weeks. The action is unprecedented.

READ THE REST

Why Is Bernanke Trying to Fight the Bear?

Last Tuesday, January 22, 2008, the US central bank lowered its federal funds rate target by a hefty 0.75% to 3.5%. The panicky decision to lower the fed funds rate target was made ahead of the Fed's meeting at the end of this month. Last Tuesday's cut by the Fed was the largest nonscheduled interest-rate cut in more than 20 years.

Last Tuesday, January 22, 2008, the US central bank lowered its federal funds rate target by a hefty 0.75% to 3.5%. The panicky decision to lower the fed funds rate target was made ahead of the Fed's meeting at the end of this month. Last Tuesday's cut by the Fed was the largest nonscheduled interest-rate cut in more than 20 years.Let us say that the present aggressive interest rate stance by the Fed fails to prevent the economy from falling into a recession; what kind of action is Bernanke then going to undertake? In some of his writings, he has suggested that, under such circumstances, the Fed should adopt a very aggressive stance and start pushing money on a massive scale, i.e., helicopter money. Needless to say that if this were to happen, Bernanke would run the risk of badly damaging the foundations of the real economy.

FULL ARTICLE

Government Regulation vs Free Markets

The overall economic ignorance displayed in this year's political campaign has been staggering. Instead of calling for balanced budgets, sound money, permanent tax reductions, and less regulation, most of the candidates have called for more inflation and more government intervention.

READ THE REST

The Sixty-Year Storm

Today’s financial crisis, triggered by the collapse of the housing bubble in the United States, also marks the end of an era of credit expansion based on the dollar as the international reserve currency. It is a much bigger storm than any that has occurred since the end of World War II.

To understand what is happening, we need a new paradigm. It is available in the theory of reflexivity, which I first proposed 20 years ago in my book The Alchemy of Finance . The theory holds that financial markets do not tend towards equilibrium. Biased views and misconceptions among market participants introduce uncertainty and unpredictability not only into market prices, but also into the fundamentals that those prices are supposed to reflect. Left to their own devices, markets are prone to extremes of euphoria and despair.

Indeed, because of their potential instability, financial markets are not left to their own devices; they are in the charge of authorities whose job it is to keep the excesses within bounds. But the authorities are also human and subject to biased views and misconceptions. And the interaction between financial markets and financial authorities is also reflexive.

Boom-bust processes usually revolve around credit, and always involve a bias or misconception – usually a failure to recognize a reflexive, circular connection between the willingness to lend and the value of the collateral. The recent US housing boom is a case in point.

READ THE REST

The Road to Hyperinflation - Part 2

It has been forgotten by many that before 1913, there was no central bank in the United States to bail out troubled commercial and associated financial institutions or to keep inflation in check by trading employment for price stability. Few want inflation but fewer still would trade their jobs for price stability.

For the first 137 years of its history, the US did not have a central bank. The nation then was plagued with recurring business cycles of boom and bust. For the past 94 years that the Federal Reserve, the US central bank, has assumed the role of monetary guardian for the nation, recurring business cycles of boom and bust have continued, often with the accommodating participation of the Fed. Central banking has failed in its fundamental functions of stabilizing financial markets with monetary policy, succeeding neither in preventing inflation nor sustaining growth nor achieving full employment. Since the Fed was founded in 1913, the US inflation has registered 1,923%, meaning prices have gone up 20 times on average despite a sharp rise inproductivity.

For the 18 years (August 11, 1987 to January 31, 2006) of his tenure as chairman of the Fed, Alan Greenspan had repeatedly bought off the collapse of one debt bubble with a bigger debt bubble. During that time, inflation was under 2% in only two years, 1998 and 2002, both times not caused by Fed policy. Paul Volcker, who served as Fed Chairman from August 1979 to August 1987, had to raise both the fed funds rate and the discount to 20% to fight hyperinflation of 18% in 1980 back down to 3.66% in 1987, the year Greenspan took over the Fed just before the October 1987 crash when inflation rose to 4.53%.Under Greenspan’s market accommodating monetary policy, US inflation reached 4.42% in 1988, 5.36% in 1989 and 6.29% in 1990. US inflation rate was moderated to 1.55% by the 1997 Asian financial crisis when Asian exporting economies devalued their currencies to lower their export prices, but Greenspan allowed US inflation rate to rise back to 3.76% by 2000. The fed funds rate hit a low of 1.75% in 2001 when inflation hit 3.76%; it hit 1% when inflation hit 3.52% in 2004; and it hit 2.5% when inflation hit 4.69% in 3005. For those years, US real interest rate was mostly negative after inflation. Factoring in the falling exchange value of the dollar, the Fed was in effect paying US transnational corporate borrowers to invest in non-dollar markets, and paying US financial institution to profit from dollar carry trade, i.e. borrowing dollars at negative rates to speculate in assets denominated in other currencies with high yields.

READ THE REST

The Great Depression - The Sequel ?

The D Bomb Is Dropped

The D Bomb Is DroppedIt’s happened. One widely read financial daily very recently dropped the “D” bomb. The article compared today's economic situation not to the 1987 affair with a happy ending, but to the much “darker metaphor” of the Great Depression in 1929.

The main similarity, according to the article was this: The all-out rescue efforts of the financial powers-that-be to stop a downturn and push the economy onto solid ground. Then as now, two main bodies carry out the task: the central bank and the White House.

1929: The Federal Reserve promises “cheaper credit” and slashes the discount rate from 5.5% (1929) to .75% (1932). At the same time, U.S. President Herbert Hoover creates an “Economic Stimulus Plan” to provide $160 million in tax relief to the public.

2008: On January 22, the Federal Reserve approves an emergency 75-basis-point rate cut, the largest single reduction in 23 years (and fourth cut in four months). Days later, U.S. President George Bush encourages Congress to support a $150 billion “Economic Stimulus” through tax rebates.

Merrill downgraded on bond insurers, subprime

READ THE REST

UBS, BNP Paribas reveal fresh hits from credit crisis

READ THE REST

Forex Market Update - 29/01/2008 - FOMC Outlook (2)

FX Insights Moderator,

Just a quick update on some things as we head in to the FOMC...

My short @ 4794 was closed @ 4793 this morning and I've not re-entered the market with any new shorts and will not re-enter with any new shorts at this point... at least not until I see what the Fed does...

I only have 1 open short and that is at 4714 and I will keep this short open for the time being... my overal bias remains euro long -- cautiously long -- I'm not adding any new longs at these levels and not adding any trades at all this close to the rate decision...

This morning's GDP data can certainly lend some credence to the possibility of at least a 50bps cut, as GDP had slowed considerably during Q4 and is presently showing signs of complete stagnation during this first quarter of 2008.

I'd like to caution against jumping into the market as soon as the rate decision is released... we could see a pull back on the EUR/USD when the decision hits the wires...

The pull back can occur as banks are either taking losses, taking profits, and or adding new long positions, which will be based on exactly what the Fed comes out with today...

Sometimes it's best to wait between 4-12 minutes to get a feel for how the price action will play out and to see how the banks will decide to respond and move the market... just some food for thought on that...

Please practice extreme risk and money management today... do not make a knee jerk trade on any of the pairs, especially the yen crosses... formulate a gameplan and stay consistent during these potentially volatile days ahead...

The Failure of Inflation Targeting

Inflation targeting is yet to be formally adopted by the Federal Reserve (Fed), but recent market and Fed actions already prove that it is a failure. At the whim of trouble in the markets, Fed Chairman Bernanke has made it clear that he is inclined to flood the markets with liquidity at any cost; he said: “We stand ready to take substantive additional action as needed to support growth and to provide adequate insurance against downside risks.”

Contrast that with John-Claude Trichet’s comments: the head of the European Central Bank (ECB) recently said that during times of financial turmoil, it is imperative that inflationary expectations remain firmly anchored. The Fed’s increasing isolation is also apparent from recent comments by Mervyn King, the governor of the Bank of England who said that investors had been mispricing risk for far too long and that “the repricing of that risk … is not a process that we should try to reverse.”

Let me be clear: we have no problem with a central bank to switch into emergency mode per se. But the way the Fed has wobbled into emergency mode, claiming to be vigilant on inflation while debasing the dollar in the process smells of hypocrisy. A central bank’s role is to keep the financial system running, not to run the financial system. Ben Bernanke has very clear views on how the financial system ought to be running. In February 2004, when he was freshly sworn in as a Fed Governor, Ben Bernanke published a report called “The Great Moderation.” In this report, he praised how monetary policy has contributed to a reduction in volatility of output and inflation since the mid 1980s. At first sight, it seems difficult to argue with such analysis; this work may have contributed to his appointment as President Bush’s Chief Economic Advisor, and subsequently to his current role as Chairman of the Federal Reserve.

While we do not deny that low volatility has positive implications, where there is sunshine, there is shadow: in our assessment, the seeds of the current crisis have been planted in the process. Even if you are not an economics Ph.D., you may recall the saying “if there is one thing the market does not like, it is uncertainty.” The less uncertain the world is, the more daring speculators become. Homeowners believing their jobs are secure, or their wages will rise, are more likely to take out a high mortgage. Any speculator is willing to take out more leverage when the future seems certain. Financial institutions have become increasingly “sophisticated” over the past decade and introduced widely acclaimed Value At Risk (VaR) models; these models assess the risk of loss given different scenarios. Put simply, the less volatility, the less uncertainty there is, the more capital may be put at risk. In recent days, there has been talk that banks may require over hundred billion in additional capital should mortgage insurers be downgraded. That’s because the banks’ models suggest that less capital is required for assets classified as safe; however, if someone spoils the party and says the world is a risky place, banks suddenly have a greater portion of their capital at risk, requiring them to either sell off risky assets on their balance sheets, or to raise more capital.

READ THE REST

Forex Market Update - 29/01/2008 - FOMC Outlook